The IRS has released Tax Tip 2021-115, an excellent reminder to be financially prepared if a natural disaster affects your life. Access to personal (and business, if applicable) financial, insurance, medical, and other records can help start the recovery process quickly. The following article provides some helpful

Read more →2021

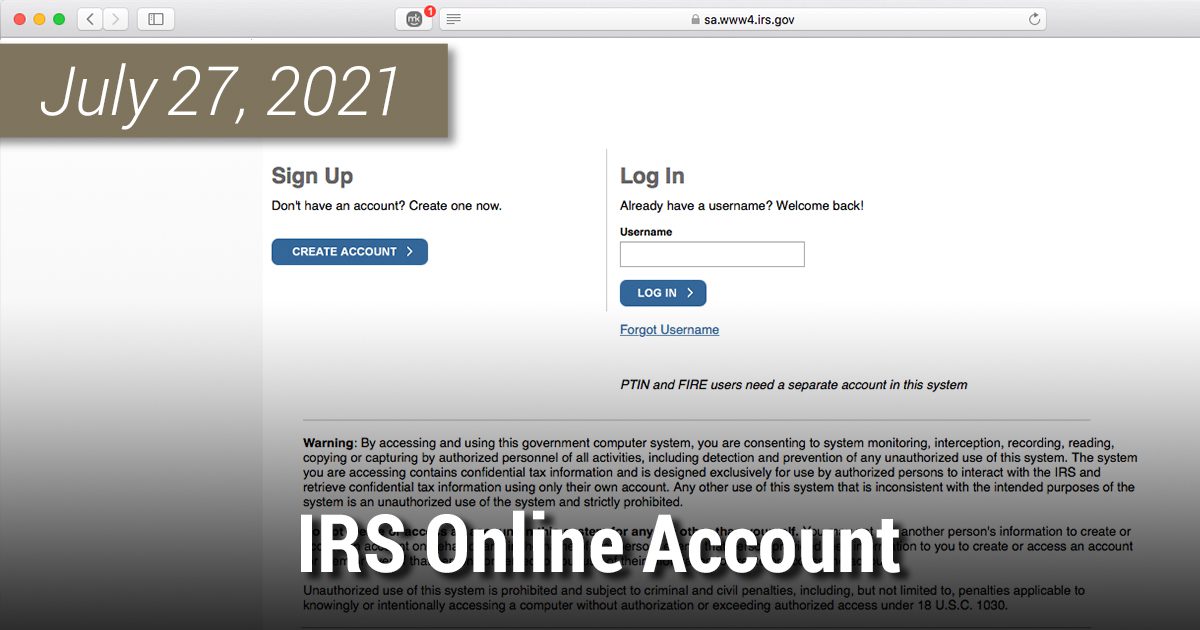

As the IRS continues to move more services online to lessen the load on their agents, having an IRS online account is becoming critical for taxpayers. It also assists tax preparers with vital information when preparing tax returns. We highly recommend enrolling for your IRS online account

Read more →The IRS provides a free recorded workshop to help small businesses owners understand various tax obligations. The following Tax Tip from the IRS has many videos focusing on different tax topics which may affect your small business. These short videos can be watched in any order and

Read more →The IRS and other agencies are expanding their efforts to enforce reporting compliance for taxpayers who transact in virtual currency. For purposes of reporting the information on you tax return, a transaction involving virtual currency includes: The receipt or transfer of virtual currency for free (without providing

Read more →Since the pandemic, many people have started hobbies, such as making jewelry or baking goods. Most people are unaware that income earned in your hobby is considered taxable income. We encourage you to check out the link below to help you understand the hobby rules. If you

Read more →To continue with the IRS warning of their top “Dirty Dozen” scams, five more were added to the list: Fake charities Immigration and senior fraud Offer in compromise mills Unscrupulous tax return preparers Unemployment insurance fraud Click the link below to read more about each type of

Read more →Earlier this week, the IRS added pandemic-related scams to the top of this year’s IRS “Dirty Dozen” of tax-related scams and schemes. The focus is on economic impact payments theft and unemployment fraud. You can click the link below to read more about these tax-related scams. As

Read more →We recently sent out an email regarding the upcoming Child Tax Credit advance that will start next month. In prior years, the Child Tax Credit for dependents 17 years of age and younger is usually a lump sum credit against income tax captured on the individual income

Read more →The advance Child Tax Credit (CTC) payments will be making their way to the pockets of many taxpayers starting next month. As you may recall, this advance payment was part of the American Rescue Plan signed into law in March which makes the CTC fully refundable and

Read more →On Monday, the IRS issued new guidance for the maximum limits of contributions allowed to a qualified individual’s HSA account for the calendar year 2022. The new 2022 annual limitations for self-only coverage under a high deductible health plan are $3,650 and $7,300 for family coverage under

Read more →